In a turbulent time for the Chinese markets, Chinese shares plunged 8% on Monday, its steepest one-day drop in eight years. The main Shanghai share index dropped 8.5% while Shenzhen’s main index fell 7.5%. The steep decline comes after a few weeks of relative stability following the Chinese government’s institution of a wide range of measures to help the market. The Chinese market’s troubles have instilled fears among investors regarding the overall health of the world’s second biggest economy. If the Chinese stock market declines continue to damage consumer confidence, it could lead to a slowdown of China’s purchases from the rest of the world, which would impact the global economy.

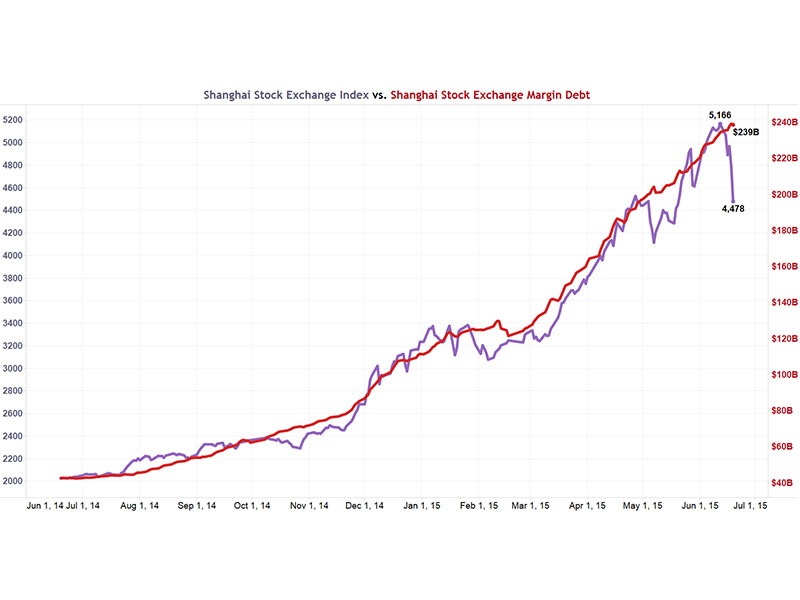

In the 12 months ending June 12, 2015, Chinese stocks surged. In addition to the normal institutional investors, millions of working-class and middle-class Chinese families purchased stocks during this period, often borrowing money to do so and further feeding the frenzy. The average Chinese citizen’s failure to understand stock valuations and basic economic fundamentals contributed to the rise. However, with such a quick rise in the market, it prompted concerns of a bubble ready to burst. As a result, shares lost greater than $3 trillion in a matter of weeks.

The bursting bubble and the associated decline in Chinese shares prompted the Chinese government to institute unprecedented, aggressive measures in order to shore up stock prices and to assuage the fear of investors. On July 8th, China’s Ministry of Finance pledged to “adopt measures to safeguard the stability of capital markets.” Such measures included the suspension of initial public offerings, the introduction of a $120 billion stabilization fund backed by the central bank and the cutting of interest rates. It also made more loans available to stock buyers and promised to investigate anyone involved in market manipulation. It further ordered brokerage houses to pump billions of dollars into the market.

Despite these drastic measures and a brief stability period, the tumult in the market continued. Even stocks that were strong performers due to the government-backed rebound were hit hard. For example, state-owned PetroChina, the country’s largest oil producer, fell 9.6% in this latest market dive. Many analysts saw the government-induced recovery as itself contributing to the crash. Without enough money to continue the stabilization, “a renewed, sharp correction is inevitable” stated Yu Jun, a strategist at Bosera Asset Management Company.

Because investors took out huge loans to buy stocks on the rise, they are now being forced to sell the stocks in order to pay the loans back. Such selloffs contributed to Monday’s decline.

The Chinese government has pledged their willingness to continue stabilization measures if the current decline persists. Zhang Xiaojun, a spokesman for the China Securities Regulatory Commission stated on July 20th that “[t]he commission will continue to stabilize the market and provide reassurance, and will use all its resources working towards the goal of preventing systemic risk.”

As of now, the Chinese stock market remains turbulent and only time will tell if Beijing’s efforts will help in the long run.

Stay Connected