In an effort to secure its market position in the ever more competitive mobile payments industry, Google has essentially split its Google Wallet app into two apps: a modified Google Wallet and the new Android Pay. The search giant hopes to legitimately compete with payment options such as Apple Pay, Venmo, Square Cash and PayPal.

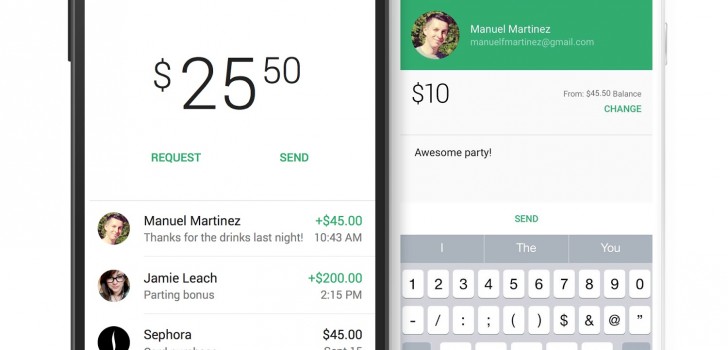

The new Google Wallet, which launched a few days ago, is a peer-to-peer payments platform that has only feature: the ability to transfer money to a Google account from a person’s bank account, debit card or Google Wallet balance. While this function previously was available in the Google Wallet app, it will not be available in the Android Pay app.

The reboot of the Google Wallet app likely means that it is not phasing out the app and transitioning to just Android Pay, but rather strongly focusing on both apps.

The new Google Wallet may face competitive challenges as it is basically Google’s version of Venmo or Square Cash. The question becomes whether users of those services will make the switch to Google Wallet. And furthermore, will those who used the old Google Wallet because of its NFC capabilities (i.e., a form of wireless communication that allows the flow of information between two devices) simply switch to the new NFC capable Android Pay? The answers to these questions remain to be seen.

Despite its possible challenges, the new Google Wallet is designed to be very user-friendly, and it makes it quite easy to send money to a friend, family member or other peer. The new Google Wallet also lets a person manage his or her Wallet Card. The card connects to a person’s account and allows him or her to pay anywhere that a debit MasterCard is accepted. It even can be used at an ATM machine.

With respect to Android Pay, Google announced that it reached deals to get the service into greater than one million locations throughout the United States – including Walgreens, Whole Foods and Macy’s to name a few.

The Android Pay app will also store loyalty cards and gift cards on mobile phones powered by Google’s Android software.

Google hopes that the reboot of Google Wallet and the launch of Android pay will be smashing successes and allow the search company to keep up with its competition. As smartphone payments are expected to grow to $188 billion by 2018, Google hopes to stay relevant and cash in on some of that growth.

Stay Connected