The $77 billion Peer to Peer (P2P) lending market is expanding exponentially thanks to Wall Street’s efforts to securitize the loans. It’s the same risky practice that led to the Great Financial Crisis, where poor quality mortgages were issued and then sold on to unsuspecting investors who later realized the losses when people couldn’t pay the loans.

P2P lending seems to be embarking down this dangerous path, allowing borrowers struggling with high-interest credit card debt to refinance via loans from individual lenders. The net effect of the transactions is transforming credit card debt into unsecured personal loans. Which are then sold to investors, who may not be aware of the precise credit quality of the very stretched borrowers.

It also presents a scenario where borrowers could subsequently max out the credit cards they just paid off.

Transferring credit risk from large financial institutions to private lenders, means it isn’t entirely clear what the implications of that shift might eventually be, especially if the market continues to grow at its present pace.

After all, using a relatively low-interest P2P loan to pay off a high-interest credit card isn’t any different than using a new credit card that comes with a teaser rate to pay off an old credit card.

Borrowers who do this often max out the old card again and thus end up with twice the original amount of debt. They then get other cards and repeat the process, accumulating huge amounts of debt that eventually must be paid off.

But the dangers get worse because of perverse incentives created by securitizing the debt and selling it to retail investors. As demand for these asset backed loans grows, it causes lenders to lower their underwriting standards.

That’s exactly what led to the housing crisis.

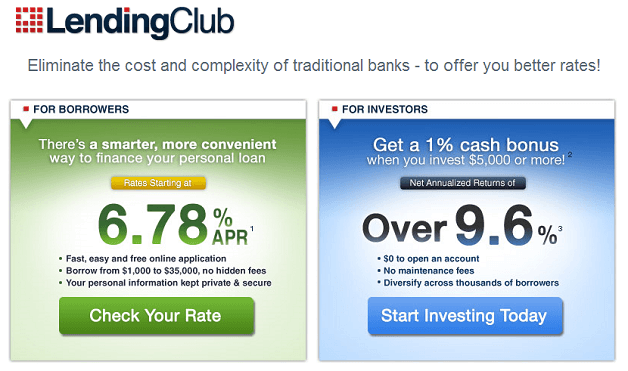

Proof of this can be seen from the industry’s number-one player, LendingClub, which is presently advertising to “pre-approved” borrowers that they can get up to $35,000 with “no collateral required.”

It’s clear that Wall Street’s securitization machine needs to be fed which means the race to the bottom is on. Its now a race to see who can recruit the most under-qualified borrowers.

We’re sure this will not end well.

Stay Connected