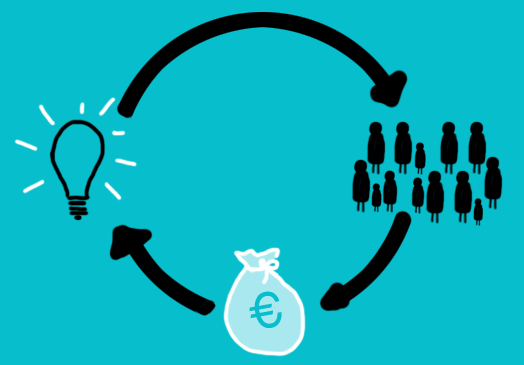

The SEC has passed historic regulations that will allow everyday Americans to invest in startups for the first time ever. Previously only rich investors were permitted to take part, limiting the opportunities available to retail investors in a world where fewer companies are raising funds on the public markets, the only allowable venue for retail investors.

The streamlined securities registration process is being called “Reg A+,” and it will change the landscape not only for startups but also for film financing and other creative projects.

The new rules permit investment offerings to the general public starting on June 19th, so long as a long list of requirements are met.

Until now, the everyday Americans has been giving away millions of dollars to startup companies on sites like Kickstarter, but only in pre-sales of actual products. Investing directly in the companies has thus far been prohibited.

This means that crowdfunded darlings that have gone on to sell for billions have provided no reward to the initial public funders.

Reg A+ is interesting for two reasons.

First, it allows equity investments in early stage companies which helps both startup companies and retail investors. This means a new asset class for investors and a new, competitive source of capital for American businesses.

Secondly, it also provides a new source of funding for creative projects like movies and TV shows. This could disrupt Hollywood studios as well as see more content created that the public wants to see – think controversial documentaries or fan favorite shows that have been cancelled because studios don’t want to take a risk.

The specific rules of the new regulations are as follows, according to TheHollywoodReporter:

➻ The offering cannot exceed $50 million within a 12-month period.

➻ The investors cannot invest more than 10 percent of the greater of (a) their annual income or (b) their net worth (excluding their home).

➻ The company making the offering (the “issuer”) has to complete a lengthy document containing detailed information in a format required by the SEC (“Form 1-A”). This document then has to be submitted and approved by the SEC before accepting any investors.

➻ The individuals involved in the offering (the “promoters”) cannot have been found guilty by a court or administrative agency of violation of securities or certain other laws.

➻ The offering material must accurately state all material facts.

➻ The issuer must file audited financials with the Form 1-A and must file follow-up reporting to the SEC with audited financial statements for at least one year (and annually if it has more than 300 investors).

➻ The promoters cannot directly sell their own interests in the issuer in excess of the lesser of (a) 30 percent of the offering or (b) $15 million.

➻ The issuer must use a registered transfer agent to record ownership and transfers by investors.

➻ The issuer does not have to comply with state securities laws (other than filing fees), which is a huge advantage compared to the impossible aggravation of having to comply with myriad conflicting state securities laws.

➻ The issuer is permitted to advertise the offering, including using social media.

➻ The issuer is allowed to “test the waters” by sending out general marketing materials as long as it doesn’t accept any investors before delivering the SEC-approved Form 1-A.

➻ The issuer can accept investment from all investors, not just “accredited investors” (meeting certain net worth requirements), and with no limit on the number of investors.

➻ The issuer can raise investments on a crowdfunding website. For example, IndieCrowdFunder.com provides all the required forms and handles filing them with the SEC as well.

Stay Connected